tax attorney vs cpa salary

The IRS requires enrolled agents to take at least 72 hours of continuing education courses every three years to maintain their knowledge of current tax laws and issues. Of the UK partner moves we included 12 moved between the Big 4 and law firms.

Cpa Vs Non Cpa Salary Key Differences Comparisons

866 303-9595 or 845.

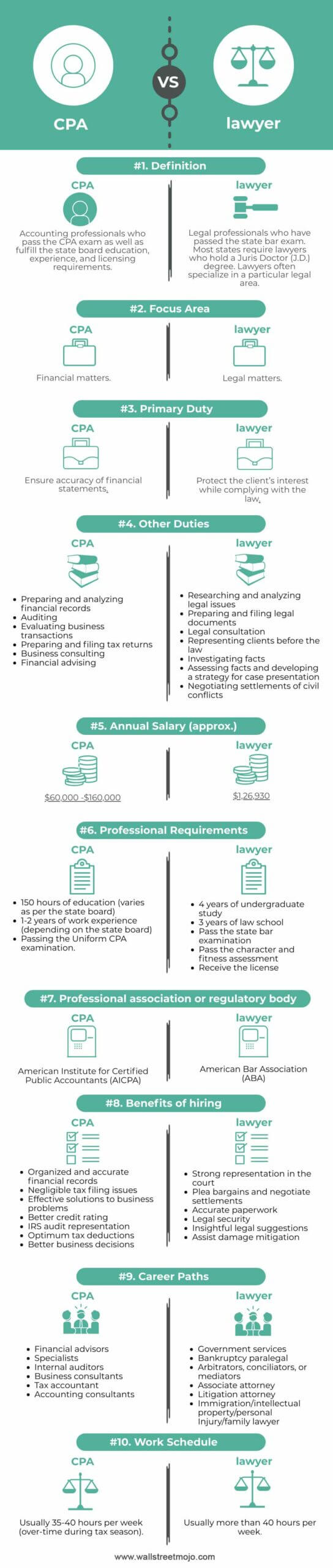

. This article will explain some of the key differences between a tax attorney and a tax accountant and why you may want one versus another to handle your taxes. Honestly tax lawyer is an entirely different path from a cpa. According to the Illinois CPA Society the average hourly rate charged by a CPA is 229 an hour.

The figure was even greater globally with 20 of the surveyed moves occurring between the different types of firm. Unlike other tax relief companies who only have Enrolled Agents CPAs or tax attorneys TRP has all three working on the right parts of your case. The total cash compensation which includes base and annual incentives can vary anywhere from.

Conversely if a dual-licensed Attorney-CPA decides to continue an accounting career he has a distinct advantage over most CPAs due to his familiarity with the. Several factors may impact earning potential including a candidates work experience degree location and certification. Made it up to director and exited in-house as Head of Tax in a F500 company.

CPAs may charge a flat rate for tax. According to PayScale a tax attorneys salary starts around 80000 per year. These charts show the average base salary core compensation as well as the average total cash compensation for the job of Tax Attorney II in the United States.

This is especially true for professional women who also want to start and maintain a family life. The average salary of a tax attorney is 120910 per year according to the BLS. Tax lawyers hourly rates are too high to justify that.

Choose a tax lawyer when receiving notices of debt. Being a CPA or an attorney can make you lots of money and bring you lots of job satisfaction. These numbers represent the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users.

With four to seven years of experience the range is 148911 to 197523 with an average of 185967. CPA vs Tax Attorney tXLyTAz2019x 2019-05-28T0837280000. The estimated additional pay is 16195.

Individuals with this certification typically work with matters of accounting and taxes. The base salary for Tax Attorney II ranges from 114062 to 154884 with the average base salary of 143191. Although tax attorneys must typically complete law school and pass a state bar exam no minimum educational requirements exist for enrolled agents.

Big4 salary is dependent on the following factors. CPAs usually work with an accounting firm but the type of clients and the exact services they provide vary. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US.

Attorneys have specific negotiation research and advocacy training and experience that allow them to achieve maximum. This results in outstanding results and an affordable cost. Tax Attorney Vs.

CPAs generally charge less for services than tax attorneys. As a general rule tax lawyers engage accountants CPA or EA for preparation of tax returns for their clients. Thats a long 5 years filled with busy seasons and lots of.

Generally the highest salary offered these days is for. Not only do you get more career opportunities in financial services and respect from your colleagues. JDLLM DC WNTS MA group.

Many so-called tax attorneys are heavily involved in more practice areas such as. You also get a pretty sweet bump in your salary and compensation. Both certified public accountants known as CPAs and tax attorneys are available to individuals and organizations attempting to navigate the often confusing universe of taxes.

With two to four years of experience the tax attorney salary ranges from 107996 to 146664 with an average salary of 135585. A tax attorney is the best fit for negotiating tax settlements audits and other complex issues with the IRS. The ceiling for cpa is much lower and compensation reflects that.

Two common programs are the CPA and CFP certifications. While both attorneys and accountants must keep your information confidential an accountant can be ordered to give up information about you and your. Entry-level tax attorney job salary ranges from 77735 to 105498.

Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning. Quality of life -- particularly worklife balance -- is a major concern for CPAs and attorneys. JDs make significantly more than the CPAs 15-20k more and that levels out when you make Manager level.

Credentials office and group. Call Now Free Consultation 866-477-5291. Most local CPAs and tax lawyers do not have the experience of representing clients in front of the IRS on a daily basis.

Tax return preparation is a time consuming process - especially when tax situation is complex and may require multiple drafts to achieve the optimal result. The average CPA salary in the US is 62410 but it also varies depending on your years of experience firm size and industry. Thats the best part about becoming a CPA.

Though if they stick you in compliance thats a total waste of resources. A tax attorney before and above all else is an attorney. Although there is a difference between a tax attorney and a CPA members of both professions work on a variety of tax-related issues and their.

But these jobs can also bring on the stress. Bonus usually isnt great but as long as youre not in compliance you will have reasonable hours and gain some great experience. CPA stands for certified public accountant.

Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. What These Certifications Indicate. CPA vs Tax Attorney.

The use of a tax accountant will also usually ensure that your internal accounting practices are valid and that the information contained therein is complete. A cpa at the big 4 will start out in the mid-50k range and maybe be at 100k after 5 years in a big metro. Salaries in the law field range from 58220 to 208000.

The estimated total pay for a Tax AccountantCPA is 89033 per year in the United States area with an average salary of 72837 per year.

Tax Accountant Career Overview

Cpa Vs Tax Attorney Top 10 Differences With Infographics

/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

Tax Law Salary Northeastern University Online

Cpa Salary And Career Outlook Accounting Com

What Can You Do With An Accounting Degree Accounting Degree Accounting Jobs Accounting

Do I Need To Hire A Tax Attorney Or Cpa To Represent Me In An Irs Tax Audit Yqa 206 2 Youtube

Tax Lawyer Salary How To Discuss

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Lawyer Salary Complete Guide Different Types Of Lawyers

The Difference Between A Tax Cpa And Ea All Your Questions Answered Basics Beyond

Cpa Vs Lawyer Top 10 Best Differences With Infographics

How Much Should An Entry Level Tax Attorney Get Paid

Cpa Vs Tax Attorney What S The Difference

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

What Does A Tax Lawyer Tax Attorney Actually Do That Is Different From Say An Accountant Or A General Practice Lawyer Quora